Staff turnover is soaring in many audit practices. But what’s behind this acceleration in employee churn? Why isn’t it enough simply to increase the number of wellbeing programs at work? And what needs to be reviewed in the planning and organization of audit assignments? We heard the differing experiences of two auditors who left after three years with one of the Big Four accounting firms.

The acceleration of staff turnover is endangering audit practices

“After three years, I didn’t know anyone in the department any more.” The experience of Caroline S., who left one of the Big Four last year, is an accurate reflection of what’s happening in accountancy firms today: more and more auditors are leaving their company after three years of experience. Some are quitting even sooner.

The high level of staff churn at the major companies is certainly a recurring theme that is akin to the “natural selection” that exists in organizations with a strong sense of hierarchy, where people are constantly being assessed and where they expect to progress each year (unless, of course, they have to repeat a year…). But this acceleration is definitely not good news. There’s the amount it costs, for a start, but also its psychological dimension. This borne out by the latest FED Finance study, which indicates that a high level of staff turnover creates a feeling of dissatisfaction among employees and their managers alike (65% and 61% respectively) due to the disruption the changes cause to internal organization.

This is particularly true since these young auditors are often leaving their jobs, but not to join another firm. “The majority of them leave to join a finance department somewhere, while others go off to take on an entrepreneurial project of some kind. But very few stay in auditing,” sums up Virginie Palethorpe, Audit Associate with responsibility for HR issues at Grant Thornton. As a result, senior auditors (with 3 to 4 years of experience) and young managers are in very short supply. And those that do stay are even busier than they were before.

Why do young auditors leave so quickly?

We know why people join one of the big accounting firms: for the effect on their CV, for the skills they gain, for the rapid assumption of managerial responsibilities, for the building of a professional network and for the opening up of positions of responsibility in the business. It’s a combination that is forever attractive: KPMG France received 47 000 applications for audit roles in 2021 alone! Loïc M., who also left one of the Big Four after 3 years, illustrates the point: “It’s like being back at school again, which is reassuring when you enter your working life. Then there’s training, assessment, promotion to the next level.”

So, why are they leaving?

- Salary: “Auditing is not very well paid, but you do progress quickly. With good assessments, the prospect is to progress each year by a good 10% - and even by 20% when you become a Senior,” explains Loïc. “But when you leave, you pick up +15 K€,” adds Caroline. In fact, pay scales in the Big Four are quite low in the early years. And profit-sharing or being awarded shares is only a fairly recent development.

- Working conditions: providing a good work-life balance has not always been the central focus of management in the big auditing firms and is something that remains strained. “I've never been on intermission,” recounts Caroline, who underlines that the traditional peaks times for business (October to April) tend to extend across the whole year. “We’re given one assignment after another, working on several cases at the same time and lacking the time to finish things off properly.”

- Pressure is a fact of life in the experience of the young staffer: permanent assessments, constant reporting, an initial experience of management, the first appointment with the client just one week after starting your job… The problem starts if it keeps going on. “When you see your overloaded Senior Manager sending out e-mails at 3 in the morning, you wonder whether you’d want to take their place,” comments the young woman who has witnessed several cases of burnout in her circle of colleagues.

- Competition: Good assignments, good assessments and good increases don’t just happen by themselves. From healthy emulation to a flattery contest, internal competition can quickly degenerate into general distrust, especially if face-to-face seminars and proper meeting opportunities have not reappeared after Covid.

- Sense of work: “When we’re on assignment, we are still usually seen as the audit police. We’re often kept apart from the staff in the company we’re auditing, we have lunch separately, etc. I wanted to help companies evolve rather than to control them,” explains Loïc.

- Opportunity: “Once we have 2 years’ experience in auditing, we become a target for headhunters,” recaps Loïc.

Getting young auditors to be loyal: lots of action, but few results

In an attempt to retain their workforce, the big firms have made working from home a widespread option and they generally offer very flexible packages. For example, at BDO, teleworking was increased to 4 days a week in 2022, with the possibility of opting for 4 continuous weeks of working from home during the year.

Various initiatives designed to improve wellbeing at work have also multiplied in recent years. But when it comes to the question of “From your point of view, has action been taken internally to limit the departure of employees?”, the auditors themselves don’t have the same answer as their managers. According to the FED Finance study, whatever the size of the firm, 80% of auditors believe that no action to this effect has been taken place within their structure… whereas 75% of the decision-makers say the opposite.

If the people in HR at the audit firms feel they have done a lot, while employees feel the opposite, then there is a problem! Clearly, loyalty cannot be bought with a climbing wall or a musical staircase. We need to get to the root of the problem.

Think first about the day-to-day work: how it’s planned and the right distribution of tasks

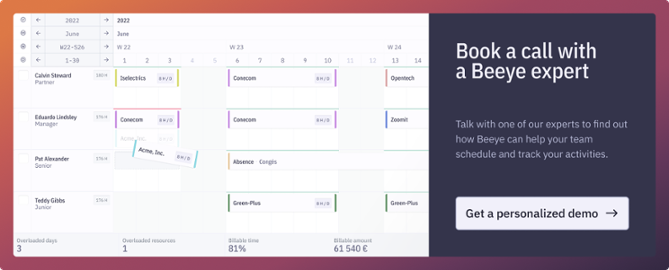

“Every week is dictated by the schedule,” explains Loïc. “In the big firm I came from, there were three or four people in the planning department. But to be honest, it was all rather cumbersome and old-fashioned. The Excel spreadsheet had just about replaced the old slotted board with cards in the corridor – and that was just about it.” The last straw for a leading practice?

What about the distribution of assignments and staffing? Caroline remembers. “As a junior, you don’t have much of a say. Sure, you expressed your preferences when you were hired, but in fact the planning system is not able to take those wishes into account.” Hence potential frustrations, made worse by the features of the assignment. There are good ones… and there are less pleasant ones, but the juniors don’t yet know that. “It’s only as you gain affinity with your manager that you can gradually choose more of the assignments you want.”

Another common problem is that, six months in advance, you may find yourself double or even triple-booked. This is caused by managers (or sometimes even partners) who want to reserve the use of ‘their’ team for a future assignment that is not yet certain. “This is the worst scenario for us,” says Loïc.

Transparency, which is highly valued by young graduates, is not high on the agenda either. “What we know about assignments and clients remains informal,” says Caroline. “Because if you don't tell the others what’s going on... you’ll be able to stay longer on a good assignment.”

How can a modern planning and staffing tool be a game-changer in an audit practice?

We help you find solutions, right here 👇

⁂