With the rise of digital transformation, the shift to accounting automation and the implementation of new audit reforms, the accounting industry can't seem to keep up. One way of staying on top of things would be to up-date your accounting firm's performance indicators.

The term performance, although defined by Sabbar as the degree of accomplishment of the objectives pursued, has several approaches: financial, organizational and social however, each type of performance is different and therefore requires its own indicator.

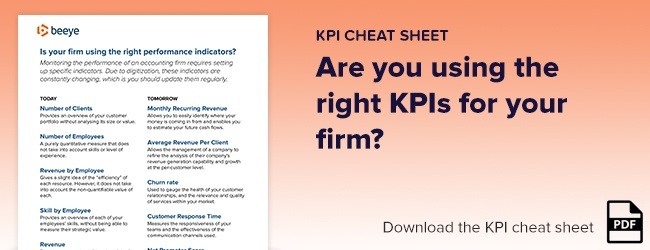

During these times of change, it's crucial to have all the right kinds of key performance indicators in place that will help you achieve operational efficiency and increase customer satisfaction. Keep in mind, that change happens regularly and to be able to adapt and sustain in today's competitive environment, your indicators MUST be up-to-date.

Challenging Tradition

Classic but Static Indicators

According to piloter.org magazine, "a performance indicator is a measure or set of measures focused on a critical aspect of the organization's overall performance."

Therefore, these indicators help to stay in line with the company's strategy.

Among the indicators inherent to the performance of an accounting firm, we found:

- Number of clients

- Revenue

- Hierarchy of procedures with clear and defined roles and responsibilities

- Number of employees and their skills

These indicators are used by accounting firms to build a solid strategy. For instance, increasing revenue means focusing on maximizing financial performance, increasing revenue could also mean focusing on getting more projects or clients but before taking on more projects you would have to check your team's capacity level to make sure they are available.

Measuring performance with these indicators is logical: It would make sense to measure financial performance with an increase in revenue. That's obvious.

What's less obvious would be to measure financial performance with an increase in price or even a cost reduction. It's the same with the number of employees, for example, is a higher number of employees good for the company's performance/productivity? Not necessarily. The question you should be asking yourself is: What about their skills? That's what is important for performance and productivity.

This is to say, that your performance indicators should not state the obvious because they won't provide you with new data or information that's essential to the growth of your firm.

A situation that's no longer justified

According to the Order of Chartered Accountants No.21, there are two types of accountants: "A good technician, whose main mission is to produce accounts for "cheap" while maintaining the level of quality or, a true leader, able to manage teams, communicate with customers, create value".

For the last ten years, accounting has taken on a new face due to task automation. This has disrupted the history of the accounting industry and shifting the accounting profession towards consultants/advisors rather than financial techniciens.

Today, accounting firms are adopting a new approach, the AaaS (Accounting as a Service) concept, by offering a subscription service. The idea here is to make the accounting industry more attractive than ever thanks to: monthly payments, skill tracking, customer loyalty (quickly responding to their requests) and versatility of employees.

⁂